The Third-Order AI Economy: The Category Map Boards Should Use to See the Next Uber Moment

Most boards are still asking how AI can reduce cost.

A smaller group is asking how AI can improve decisions. But very few are asking the structural question that defines real advantage: how does AI reorganize markets?

Every major technology wave follows the same arc—first efficiency, then redesign, then category creation. We are now entering the third phase of AI. And the boards that see it early will not just deploy AI. They will shape the next profit pools.

Third-Order AI Economy

Most boards are still stuck in a first-order AI story:

“Where can AI improve efficiency?”

A smaller set has moved to a second-order AI story:

“How do we embed AI into workflows so decisions become faster, safer, and more consistent?”

But the real board-level opportunity is the Third-Order AI Economy—the phase where AI doesn’t just improve companies.

It reorganizes markets.

That’s the “Uber moment” pattern I am pointing to:

- Internet (Order 1): information goes online

- Online business (Order 2): transactions and distribution redesign (e-commerce, search, digital ads)

- Platform markets (Order 3): coordination gets reinvented (Uber, Airbnb, Zomato, Zepto)

AI follows the same arc—except the infrastructure is not bandwidth or browsers.

It is cheap cognition: systems that can interpret context, plan actions, negotiate options, and execute across tools.

And once cognition becomes cheap and continuous, something deep changes:

Coordination becomes programmable

When coordination becomes programmable, markets redraw their boundaries—because the cost of matching, negotiating, monitoring, enforcing, and resolving disputes collapses.

This article gives you a board-usable category map—a way to spot:

- where third-order profit pools will emerge,

- which control points will form,

- and what your enterprise must build now to participate (or defend itself).

What Is the Third-Order AI Economy?

The Third-Order AI Economy is the phase of AI disruption where new types of firms and new market structures emerge because AI can coordinate decisions and actions at machine speed.

Think of it as a progression:

AI moves from “advice” → “execution” → “market coordination.”

You can already see the shift in serious executive discourse:

- HBR has begun describing how organizations will need “agent managers” as AI agents move from experiments into operational execution. (Harvard Business Review)

- HBR is also openly discussing “agentic commerce”—a world where AI agents increasingly find, compare, and even purchase products, forcing brands to adapt. (Harvard Business Review)

- WEF has published a structured framework for evaluation and governance of AI agents as they move into real-world deployment. (World Economic Forum)

- Fortune is framing AI agents as a structural force reshaping enterprise software competition—even if they don’t “kill SaaS,” incumbents “can’t sleep easy.” (Fortune)

Third-order is not hype.

It is the market layer of the AI disruption.

Why Boards Keep Missing Third-Order Opportunities

Boards typically ask AI questions in the wrong sequence:

- “Where can we automate?” (first-order)

- “Where can we augment decisions?” (second-order)

- “How does AI change our market structure?” (third-order)

The third question feels abstract—until you have a map.

And here’s the key shift boards must internalize:

The board’s job is not to choose models

The board’s job is to identify:

- where profit pools will move,

- which control points will matter,

- which new intermediaries will appear,

- and what must be built inside the enterprise to capture (or defend) value.

The Category Map: 7 Third-Order Business Categories Boards Must Track

These are not “use cases.”

These are new types of businesses—often cross-industry—built on scalable judgment and autonomous coordination.

1) Agentic Marketplaces

What it is: Markets where AI agents perform matching, negotiation, scheduling, and settlement dynamically.

The Uber pattern: A marketplace becomes possible when the cost of coordination collapses.

Agents collapse coordination cost by handling search, comparison, negotiation, execution, monitoring, and dispute handling continuously.

Simple example:

A procurement agent doesn’t just pick a vendor. It negotiates terms, monitors delivery risk, reroutes if performance degrades, and documents compliance—without waiting for humans to manage every exception.

Board watch signal: When marketplaces start offering agent APIs and machine-readable policies, market coordination is becoming agent-native.

2) Machine-Customer Infrastructure

What it is: Businesses that help companies sell to AI buyers—not just humans.

This is becoming mainstream: HBR is already outlining how brands must adapt as AI agents increasingly do the shopping. (Harvard Business Review)

Simple example:

A customer asks an agent:

“Find the best phone under $300 with good camera, long battery, and warranty.”

The agent chooses based on structured signals—not your branding story.

Implication for boards:

- SEO becomes agent optimization

- branding becomes trust + evidence

- conversion becomes policy + provenance

Board watch signal: When agent-mediated shopping becomes a dominant funnel, winners will be brands with agent-readable trust.

3) Outcome Underwriting and AI Warranties

What it is: Firms that insure, warranty, and underwrite outcomes in an AI-driven world.

The moment AI can act, boards demand accountability.

But accountability doesn’t scale via manual review.

It scales via:

- evidence,

- monitoring,

- and warranties.

Simple example:

A logistics optimization agent guarantees delivery-time reduction.

A warranty layer offers compensation if results fall below an agreed band—because actions and decision trails are auditable.

Board watch signal: When vendors bundle “outcome guarantees,” you’re watching the early formation of trust markets.

4) Judgment Utilities (Decision-as-a-Service)

What it is: Providers that specialize in high-frequency, high-stakes decisions and sell “judgment” like a utility.

Not every company will build best-in-class judgment loops for every domain.

Some decisions will be externalized—especially where specialization and continuous learning matter.

Simple examples:

- Fraud detection utilities

- Compliance decision services

- Credit risk engines for niche segments

- Forecasting judgment utilities for specific verticals

Board watch signal: When pricing shifts from “software seats” to decisions or outcomes, a utility layer is forming.

5) Compliance-as-Runtime

What it is: Platforms that enforce policy continuously as AI acts—across tools, agents, and data.

WEF’s governance framing signals exactly this direction: as agents move into production, organizations need structured evaluation and progressive governance approaches. (World Economic Forum)

Simple example:

An agent wants to approve an exception.

A compliance runtime checks policy constraints, jurisdiction rules, and risk thresholds in the moment—not in quarterly audits.

Board watch signal: The rise of policy engines, agent governance platforms, and evidence frameworks.

6) Synthetic Operations (Autonomous Ops Orchestration)

What it is: Firms that orchestrate operations end-to-end using agents: inventory, routing, staffing, maintenance, demand, procurement.

Simple example:

Retail operations become a real-time graph:

- demand signals change

- inventory reroutes

- staffing adjusts

- pricing adapts

- exceptions escalate

- evidence logs every action

This is how third-order creates “Zepto-like” leaps: not faster humans—machine-speed coordination.

Board watch signal: When platforms move from dashboards to closed-loop action systems, this category accelerates.

7) Evidence & Provenance Networks

What it is: Infrastructure businesses that provide proof: what was decided, why, by which agent, using what data, under what policies.

Third-order markets require trust at machine speed.

If agents negotiate with agents, disputes are settled by evidence artifacts—not memory.

Simple example:

A B2B dispute becomes a “decision ledger” dispute: what was authorized, what constraints were applied, what rationale existed, what executed.

Board watch signal: When enterprises treat evidence as a product (not just logs), this becomes a foundational layer.

The Board Lens: Control Points (Where Power Will Concentrate)

In every disruption, value migrates to control points before it shows up as profits.

In the third-order AI economy, boards should track five control points:

- Agent identity and delegation (who can act, under what authority)

- Policy enforcement (constraints, compliance, reversibility)

- Tool access (what agents can touch in systems of record)

- Memory and context (the context moat; institutional learning)

- Evidence and settlement (auditability, liability routing, trust)

This is why the platform battle around agents is strategically important. Fortune is already framing the competitive tension clearly. (Fortune)

What Boards Should Do Now

Third-order is exciting, but it’s not “buy an agent and win.”

Boards should focus on building the conditions for third-order participation.

1) Identify your “profit-pool decisions”

Pick 5–10 decisions that explain your economics:

- pricing and packaging

- risk and fraud

- retention and churn

- supply allocation

- procurement performance

- credit exceptions

- claims and disputes

2) Convert those decisions into governed systems

This is where Intelligence-Native Enterprise becomes the prerequisite:

- clear decision ownership

- policy constraints

- evidence trails

- safe escalation

- reversible action paths

3) Run a “third-order adjacency scan”

Ask:

- Which of our core decisions could become a market utility?

- Which workflows could become an agentic marketplace?

- Where could we underwrite outcomes as a new business line?

- Can we become a control point in our ecosystem?

4) Build for “agent-readiness”

If the machine customer era arrives, your enterprise must be interpretable to agents:

- structured product/service specifications

- machine-readable policies

- verifiable claims (provenance)

- clear dispute and redress paths

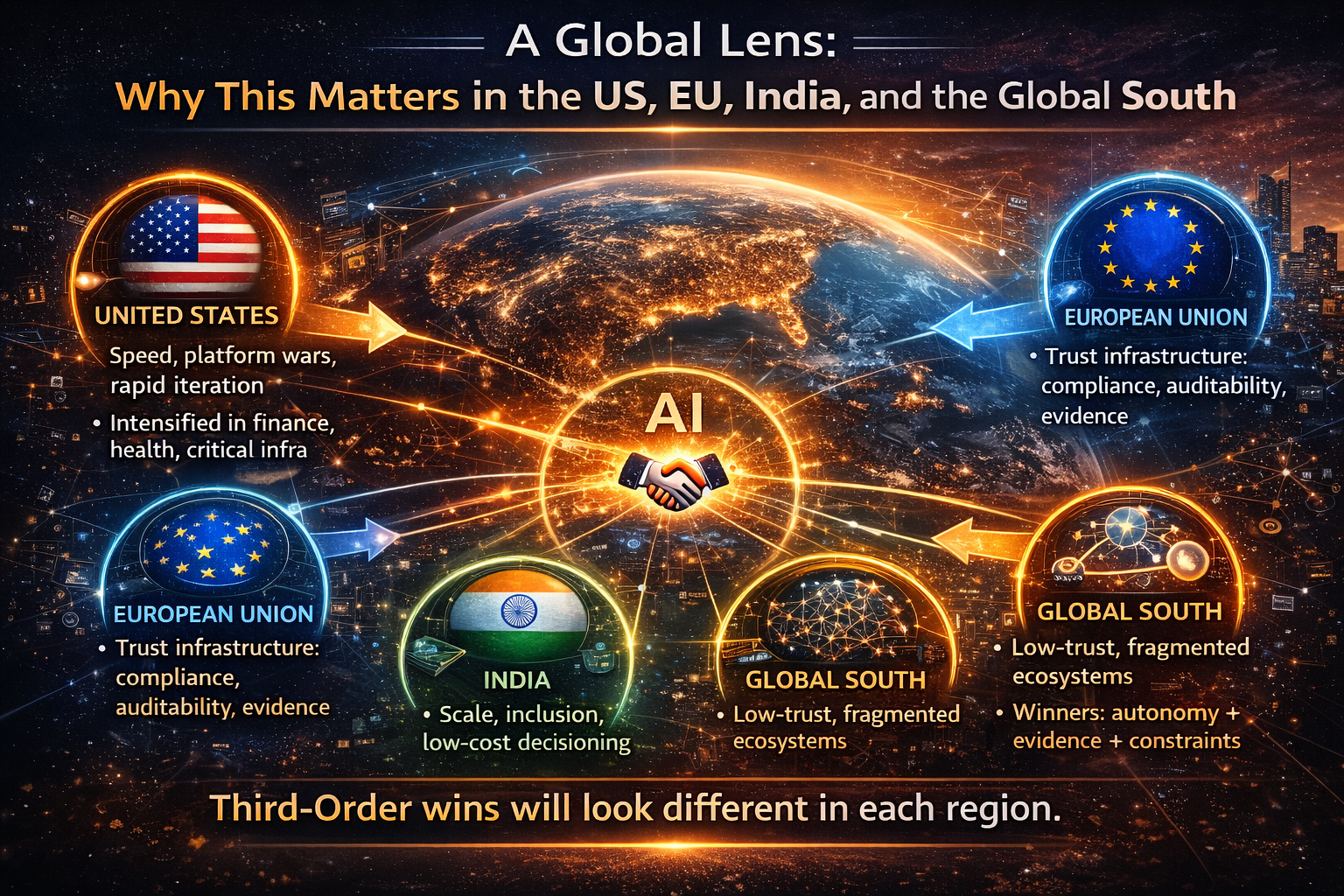

A Global Lens: Why This Matters in the US, EU, India, and the Global South

The third-order AI economy will not look identical everywhere.

United States

Speed, category creation, and platform wars dominate. Expect aggressive deployment and fast iteration—then rapid hardening after failures in high-stakes sectors.

European Union

The EU’s comparative advantage is likely to be trust infrastructure: compliance, auditability, evidence. In many sectors, “trust at scale” becomes a competitive advantage.

India

India’s third-order opportunity is scale + inclusion: delivering high-quality decisions at low cost across large populations and fragmented contexts. This is where intelligence-native design can become a growth engine.

Global South

Winners will build platforms that handle fragmented markets—lower trust, inconsistent infrastructure, uneven data—by combining autonomy with strong evidence and constraints.

What to Watch: 10 Signals Your Industry Is Entering Third-Order Creation

- Customers start using agents as the default discovery interface (Harvard Business Review)

- Vendors ship outcome guarantees and warranty-like contracts

- “Agent management” becomes an executive priority (Harvard Business Review)

- Governance and evaluation frameworks move from theory to implementation (World Economic Forum)

- Pricing shifts from seats to outcomes/decisions

- Evidence becomes required for liability and dispute resolution

- Agent platform control points consolidate (Fortune)

- New roles appear: agent managers, autonomy reliability, evidence stewards (Harvard Business Review)

- Switching costs shift from configuration to context/memory

- Ecosystems standardize machine-readable policies and permissions

Conclusion: How Boards See the Next Uber Moment Early

The first era of AI created excitement.

The second era creates productivity and decision improvement.

The third era creates new markets.

The board mistake is waiting for “success stories” before acting.

In every disruption, by the time success stories are obvious, control points are already owned and capital has already moved.

The board advantage is not predicting the future perfectly.

It is building the enterprise that can participate:

- governed autonomy

- decision quality as infrastructure

- evidence as a first-class output

- context as a moat

- market coordination as strategy, not accident

The Third-Order AI Economy will produce the next Uber moments.

The question is whether your organization will be a spectator—or a category creator.

Glossary

Third-Order AI Economy: The phase where AI reorganizes markets and creates new categories of firms.

Intelligence-Native Enterprise: A firm designed to scale decision quality with governed autonomy and evidence.

Agentic Marketplace: A market where AI agents match, negotiate, and execute transactions.

Machine Customer: AI agents that discover, compare, negotiate, and purchase on behalf of people or firms.

Compliance-as-Runtime: Continuous enforcement of policy during autonomous action.

Outcome Underwriting: Warranty/insurance mechanisms that guarantee AI-driven outcomes.

Evidence & Provenance Network: Systems that generate proof of decisions, actions, and constraints for audit, dispute resolution, and trust.

FAQs

1) Is the Third-Order AI Economy only for tech companies?

No. Banking, insurance, telecom, retail, logistics, healthcare, manufacturing, and public services all run on high-frequency decisions under uncertainty.

2) How is this different from digital transformation?

Digital transformation scaled execution. Third-order AI scales judgment and market coordination.

3) What is the first practical board step?

Identify 5–10 profit-pool decisions, then build governed, evidence-backed autonomy around them.

4) Will regulation slow third-order AI?

Regulation will shape it. In many industries, trust and evidence become competitive advantage. (World Economic Forum)

5) What’s the biggest strategic risk?

Treating this as pilots and tools instead of a market-structure shift—because by the time it’s obvious, control points are already owned.

References and further reading

- HBR on “agent managers” as agents move into execution (Harvard Business Review)

- HBR on brands adapting when AI agents do the shopping (Harvard Business Review)

- WEF report on evaluation and governance foundations for AI agents (World Economic Forum)

- Fortune on agents reshaping competitive dynamics for enterprise software (Fortune)

- Institutional Perspectives on Enterprise AIMany of the structural ideas discussed here — intelligence-native operating models, control planes, decision integrity, and accountable autonomy — have also been explored in my institutional perspectives published via Infosys’ Emerging Technology Solutions platform.

For readers seeking deeper operational detail, I have written extensively on:

- What Makes an Enterprise Intelligence-Native? The Blueprint for Third-Order AI Advantage

https://blogs.infosys.com/emerging-technology-solutions/artificial-intelligence/what-is-enterprise-ai-the-operating-model-for-compounding-institutional-intelligence.html - Why “AI in the Enterprise” Is Not Enterprise AI: The Operating Model Difference Most Organizations Miss

https://blogs.infosys.com/emerging-technology-solutions/artificial-intelligence/why-ai-in-the-enterprise-is-not-enterprise-ai-the-operating-model-difference-that-most-organizations-miss.html - The Enterprise AI Control Plane: Governing Autonomy at Scale

https://blogs.infosys.com/emerging-technology-solutions/artificial-intelligence/the-enterprise-ai-control-plane-governing-autonomy-at-scale.html - Enterprise AI Ownership Framework: Who Is Accountable, Who Decides, and Who Stops AI in Production

https://blogs.infosys.com/emerging-technology-solutions/artificial-intelligence/enterprise-ai-ownership-framework-who-is-accountable-who-decides-and-who-stops-ai-in-production.html - Decision Integrity: Why Model Accuracy Is Not Enough in Enterprise AI

https://blogs.infosys.com/emerging-technology-solutions/artificial-intelligence/decision-integrity-why-model-accuracy-is-not-enough-in-enterprise-ai.html - Agent Incident Response Playbook: Operating Autonomous AI Systems Safely at Enterprise Scale

https://blogs.infosys.com/emerging-technology-solutions/artificial-intelligence/agent-incident-response-playbook-operating-autonomous-ai-systems-safely-at-enterprise-scale.html - The Economics of Enterprise AI: Designing Cost, Control, and Value as One System

https://blogs.infosys.com/emerging-technology-solutions/artificial-intelligence/the-economics-of-enterprise-ai-designing-cost-control-and-value-as-one-system.html

Together, these perspectives outline a unified view: Enterprise AI is not a collection of tools. It is a governed operating system for institutional intelligence — where economics, accountability, control, and decision integrity function as a coherent architecture.

The Enterprise AI Doctrine: From Decision Scale to Institutional Redesign

Over the past few months, I’ve been building a structured doctrine around Enterprise AI — not as a technology trend, but as an institutional redesign agenda.

It unfolds in layers:

🔹 1️⃣ Decision Economics

- Decision Scale: Why Competitive Advantage Is Moving from Labor Scale to Decision Scale

https://www.raktimsingh.com/decision-scale-competitive-advantage-ai/

→ Establishes the core thesis: advantage is shifting from scaling labor to scaling decision quality.

🔹 2️⃣ Institutional Transformation

- The Future Belongs to Decision-Intelligent Institutions

https://www.raktimsingh.com/the-future-belongs-to-decision-intelligent-institutions/

→ Argues that AI leadership is not about tooling — it is about institutional architecture.

🔹 3️⃣ Sector-Level Redesign

- The Institutional Redesign of Indian IT: From Services Firms to Intelligence Institutions

https://www.raktimsingh.com/institutional-redesign-indian-it-intelligence-institutions/ - From Labor Arbitrage to Intelligence Arbitrage: Why Indian IT’s AI Reinvention Will Define the Next Decade

https://www.raktimsingh.com/from-labor-arbitrage-to-intelligence-arbitrage-why-indian-its-ai-reinvention-will-define-the-next-decade/

→ Examines how this shift reshapes industry structure, economics, and competitive positioning.

🔹 4️⃣ Economic Consequences

- The End of Averages: Why Precision Growth Will Define the Next Decade of Enterprise Strategy

https://www.raktimsingh.com/precision-growth-end-of-averages-enterprise-ai/ - What Is the AI Dividend? How Boards Capture Structural Gains from Enterprise AI

https://www.raktimsingh.com/ai-dividend-boards-structural-gains/

→ Explores how decision intelligence translates into measurable structural gains.

🔹 The Unifying Thesis

Together, these articles form a coherent framework:

- Competitive advantage is moving from labor scale to decision scale

- Institutions must evolve from services firms to intelligence institutions

- AI must shift from isolated pilots to structurally governed, economically accountable enterprise systems

This is not AI adoption.It is enterprise redesign.

- What Makes an Enterprise Intelligence-Native? The Blueprint for Third-Order AI Advantage

Raktim Singh is an AI and deep-tech strategist, TEDx speaker, and author focused on helping enterprises navigate the next era of intelligent systems. With experience spanning AI, fintech, quantum computing, and digital transformation, he simplifies complex technology for leaders and builds frameworks that drive responsible, scalable adoption.