Decision Velocity in the AI Age

The new advantage isn’t having the best strategy. It’s having the fastest learning loop.

Markets don’t consistently reward “the smartest plan” anymore. They reward something more practical—and far more decisive: the organization that learns fastest, at scale.

Across industries, the difference between winning and losing is increasingly shaped by one invisible factor: how quickly an enterprise can detect change, interpret it correctly, decide what to do, execute the response, and learn from the outcome—before the window closes.

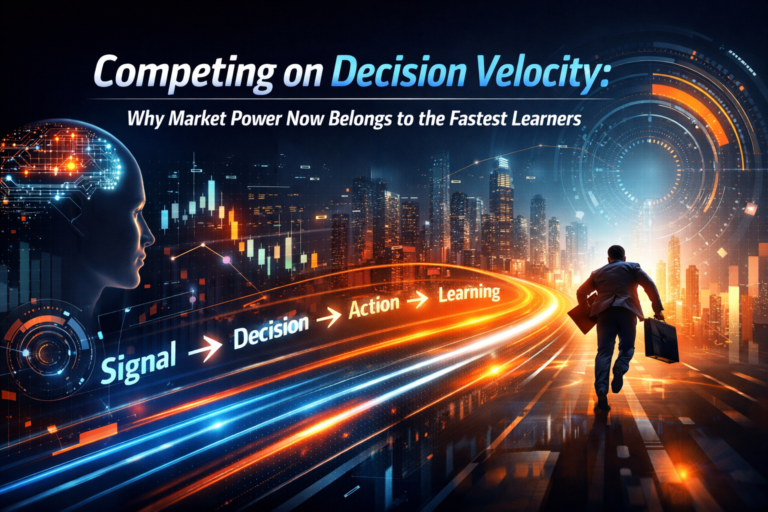

That capability has a name:

Decision velocity.

Not the speed of meetings.

Not the volume of activity.

Not “moving fast and breaking things.”

Decision velocity is the compression of the full decision cycle:

Signal → Insight → Decision → Action → Outcome → Learning

AI is accelerating every part of that cycle: it makes sensing cheaper, insight faster, and execution more automatable. But this creates a new reality many leadership teams underestimate:

As AI accelerates the outside world, the bottleneck shifts inside the enterprise—into organizational latency.

And organizational latency doesn’t look like “slow technology.” It looks like:

- unclear decision rights

- slow escalation pathways

- disconnected systems

- inconsistent definitions (“which number is true?”)

- governance that arrives after damage is done

- learning that never gets captured

In the AI age, market power increasingly belongs to enterprises that can learn faster than the environment changes.

Why decision velocity is becoming the new source of market power

When markets moved slowly, organizations could rely on quarterly planning cycles and layered approvals. A competitor’s move might take months to show up in your numbers. Supply disruptions took time to ripple. Customer preference shifts spread gradually.

Now markets behave differently:

- customer behavior changes faster

- competitor moves propagate faster

- operational risks compound faster

- information spreads instantly

- execution can be automated

When change accelerates, the advantage shifts from having a plan to having a loop.

This logic is not new. Military strategist John Boyd’s OODA loop—Observe, Orient, Decide, Act—captured why agility can overcome scale: the winner often isn’t the one with the most resources, but the one that can cycle faster and force the other side to react late. (Wikipedia)

What’s new is that AI makes this loop scalable inside enterprises—not just for elite teams, but across pricing, risk, operations, security, and customer workflows.

Decision velocity is not “going faster.” It is removing latency.

A fast organization is not one that rushes decisions.

A fast-learning organization is one that removes friction from the decision pipeline:

- less time to detect meaningful signals

- less time wasted in interpretation disputes

- less time waiting for approvals

- less time to execute across systems

- faster feedback capture

- faster updates to thresholds, rules, and playbooks

Think of decision velocity as the enterprise version of “reaction time”—but with one crucial difference:

Decision velocity is not only speed. It is speed with learning.

If you move fast but don’t learn, you’re just generating motion.

If you learn fast and act fast, you’re compounding advantage.

The simplest way to understand decision velocity: four everyday examples

1) Pricing: from weekly updates to continuous margin control

Imagine two companies selling similar products.

- Company A reviews prices weekly.

- Company B detects demand shifts daily, updates pricing rules automatically, and learns from outcomes.

Both have the same product and similar costs. But Company B can:

- avoid unnecessary discounting

- respond faster to demand spikes

- adjust to competitor moves sooner

- clear inventory without collapsing margin

This is why dynamic pricing is expanding: it’s not about “changing prices.” It’s about compressing decisions—detect demand → decide price → execute → learn. (Harvard Business School Online)

2) Customer retention: from dashboards to interventions

A dashboard that shows churn risk is not market power.

Market power is when the enterprise can:

- detect churn signals early

- select the best intervention

- deploy it immediately in the workflow

- measure whether it worked

- improve the policy next time

Two enterprises can use similar models. The one with higher decision velocity captures more lifetime value—not because it “knows” more, but because it acts and learns faster.

3) Cybersecurity: from alert fatigue to containment loops

Security teams often drown in alerts.

Decision velocity turns security into a controlled loop:

- triage signals automatically

- escalate only what matters

- isolate affected assets quickly

- confirm impact

- update detection policies continuously

In security, speed matters because the cost curve is nonlinear: small delays can become large incidents.

4) Operations: from manual overrides to self-correcting workflows

Many enterprises run on hidden operational friction:

- mismatched data

- repeated reconciliations

- policy exceptions handled manually

- approvals that exist “because they always existed”

AI can reduce this by learning which exceptions deserve human attention and which can be handled through stable policies—raising decision velocity while reducing load.

The global proof: why small speed edges can dominate outcomes

If you want a clean mental model of decision velocity becoming market power, look at high-frequency trading.

In that environment, a tiny speed advantage can create outsized advantage.

Research from the Bank for International Settlements shows that “latency-arbitrage races” can be extremely frequent and extremely fast—measured in microseconds. (Bank for International Settlements)

Most enterprises are not trading firms. But the principle generalizes:

When environments become digital and reactive, small decision-latency advantages can compound into durable performance gaps.

This is the deeper point boards should care about:

Decision velocity is not an efficiency metric. It is a market power metric.

Where time is actually lost inside enterprises

In most organizations, the real delay is not “getting data.”

It’s in orientation—the step where humans and institutions decide what the signal means, what action is allowed, and who has the authority to act. The “Orient” phase is central because it shapes both speed and correctness. (Wikipedia)

Here are the most common enterprise latency traps:

1) Decision rights are unclear

People don’t know:

- who decides

- what thresholds trigger action

- what can be automated

- when escalation is required

So they escalate everything, which slows everything.

2) Metrics are not operationalized

The organization “knows” something (in a report), but that knowledge doesn’t become action because there is no embedded decision policy.

3) Execution can’t happen cleanly

Even when the decision is made, execution requires stitching across tools, approvals, and manual steps. The decision is “approved,” but nothing changes.

4) Feedback is not captured

The enterprise acts—but doesn’t capture the outcome in a structured way that improves the next decision.

Without feedback, there is no learning.

Without learning, there is no compounding.

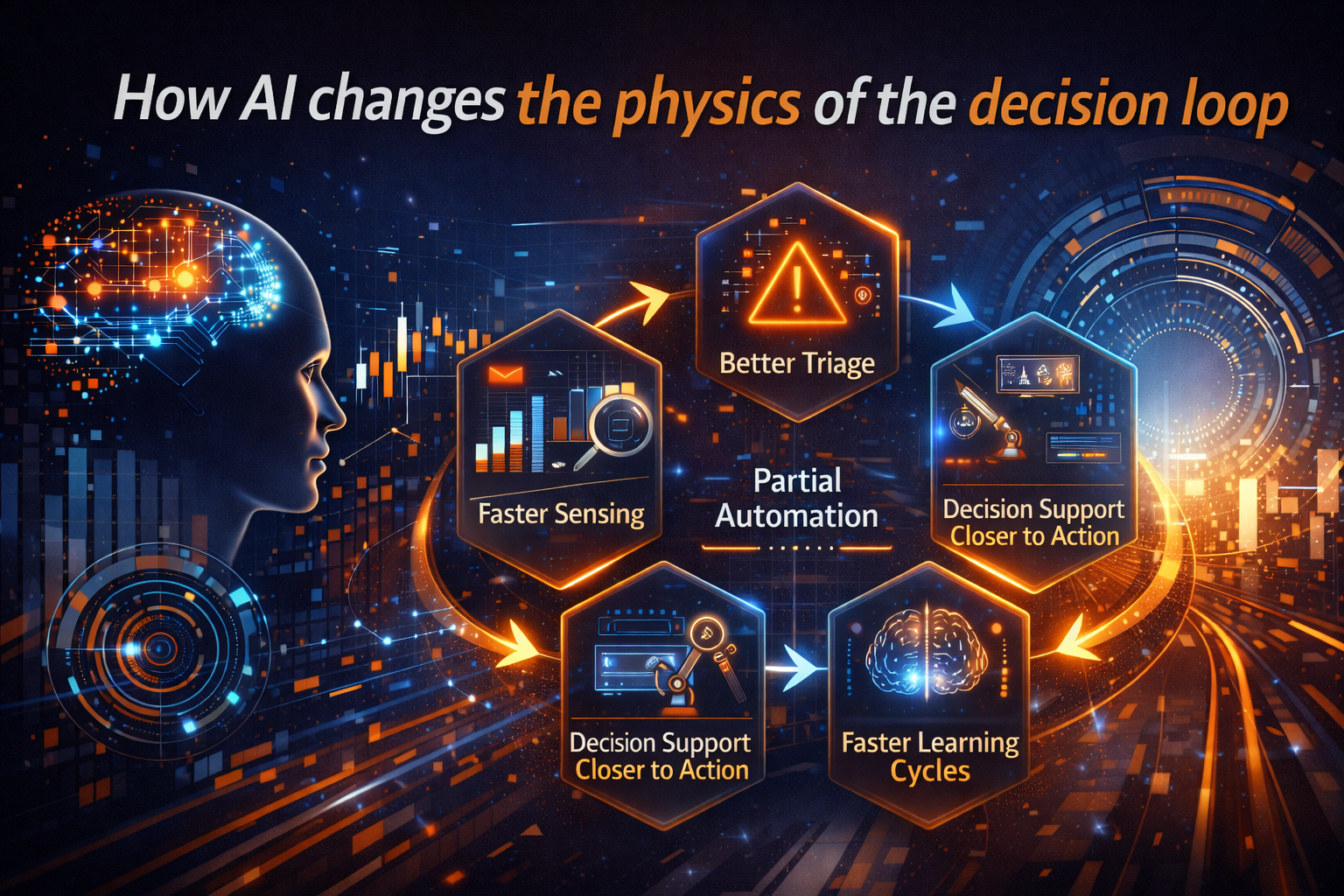

How AI changes the physics of the decision loop

AI improves decision velocity in five concrete ways:

1) Faster sensing

AI can monitor signals continuously across customer behavior, operational telemetry, risk indicators, and market shifts.

2) Better triage

AI can prioritize what matters, reducing noise and human overload.

3) Decision support closer to action

Instead of insights living in dashboards, AI can inject recommendations into workflows—where decisions actually occur.

4) Partial automation through policies

AI can execute routine decisions through thresholds and policies—reserving humans for high-impact judgment calls.

5) Faster learning cycles

AI can evaluate outcomes and tune decision policies over time.

This aligns with “sense-and-respond” thinking: real-time observation, internal speed, and continuous adaptation as a competitive discipline. (Corporate Finance Institute)

Decision velocity is a dynamic capability—now demanded at board level

There’s a reason “sensing, seizing, transforming” appears repeatedly in strategy research: it describes how firms adapt in fast-moving environments.

David Teece defines dynamic capability as the ability to integrate, build, and reconfigure competencies to address rapidly changing environments. (David J. Teece)

Decision velocity is what dynamic capability looks like when operationalized:

- sensing earlier

- seizing faster

- transforming continuously

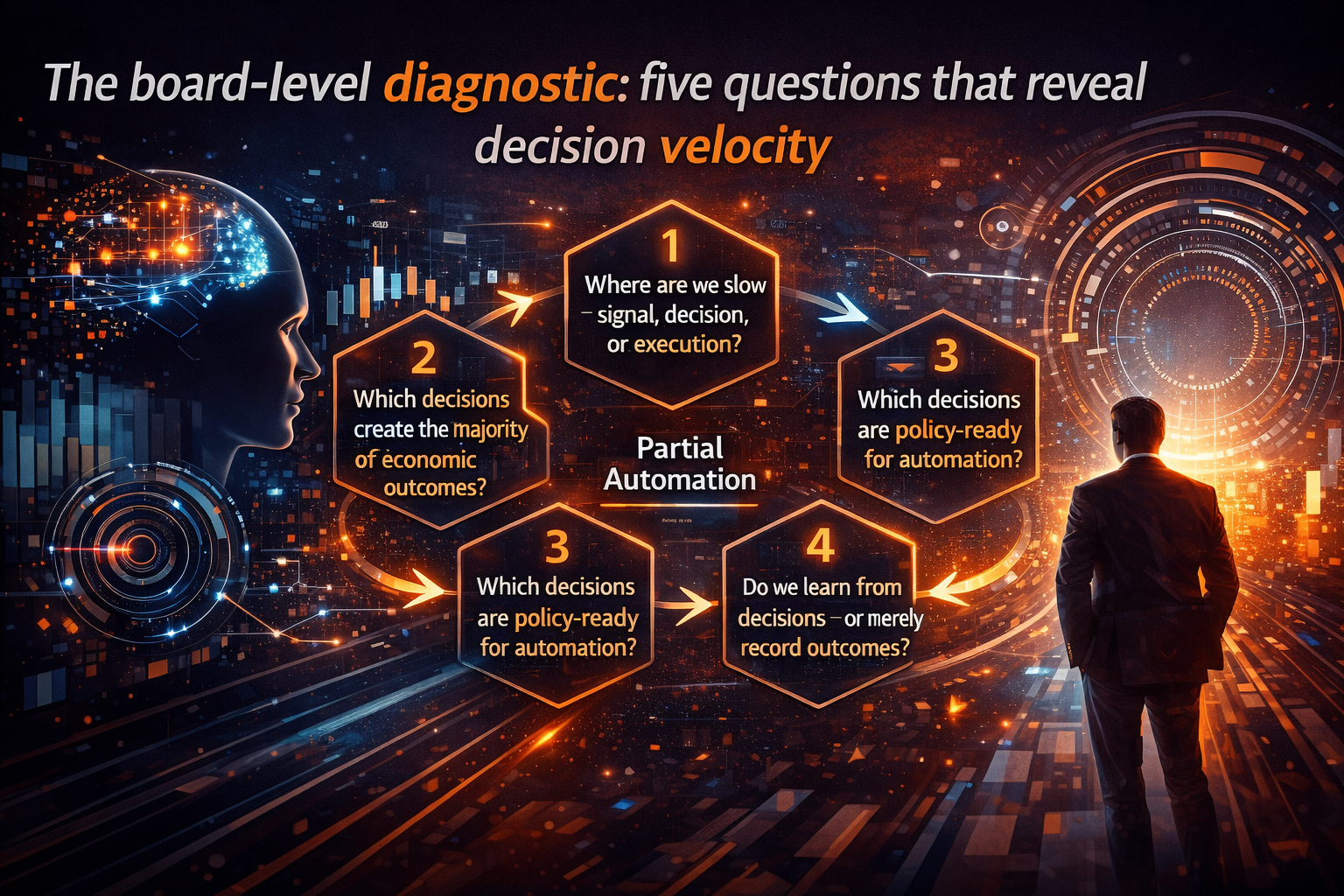

The board-level diagnostic: five questions that reveal decision velocity

If the goal is to help board members navigate AI and unlock value, these are the questions that matter:

1) Where are we slow—signal, decision, or execution?

If signals are slow: improve instrumentation.

If decisions are slow: fix decision rights, thresholds, escalation logic.

If execution is slow: fix integration and automation pathways.

2) Which decisions create the majority of economic outcomes?

Not all decisions matter equally. Focus on high-leverage decision domains such as:

- pricing and discounting

- risk thresholds

- fraud interventions

- inventory and fulfillment

- service resolution policies

- security containment decisions

3) Which decisions are policy-ready for automation?

Automation is not “replace humans.”

It is “automate what is stable, measurable, and reversible.”

4) Do we learn from decisions—or merely record outcomes?

If rationale and outcomes aren’t captured, learning can’t compound.

5) Do we have a cadence for updating decision logic?

Markets change. Policies must update. Decision velocity requires continuous refresh.

The biggest mistake: optimizing models while ignoring the organization

Many enterprises chase accuracy improvements while keeping the same slow decision pipeline.

But the advantage isn’t only in “knowing.” It’s in acting sooner and learning faster.

If the decision loop is slow, better models won’t save you.

They will simply make slow decisions more confidently.

A practical playbook: increasing decision velocity without losing trust

Here’s a simple, non-technical approach that works in real organizations:

Step 1: Pick one decision domain and map the loop

Examples: discount approvals, fraud blocks, inventory reorders, service credits.

Map:

- where the signal comes from

- who decides

- what tools are used

- how action happens

- how outcomes are measured

Step 2: Define decision policies in plain language

What triggers action?

What is reversible?

What requires human approval?

Step 3: Embed policies into workflows

Don’t leave policy in slides. Put it where work happens.

Step 4: Instrument outcomes

Capture what happened, why it happened, and what changed.

Step 5: Establish a refresh rhythm

Weekly or monthly policy updates beat annual strategy refreshes.

This is how you get speed and trust—and why decision velocity becomes sustainable rather than chaotic.

Glossary

Decision velocity: The speed at which an organization moves from signal to action to learning.

Decision latency: The time lost inside the organization between insight and execution.

OODA loop: Observe–Orient–Decide–Act. A decision cycle model emphasizing agility and adaptation. (Wikipedia)

Dynamic capabilities: The enterprise ability to sense opportunities, seize them, and transform continuously. (David J. Teece)

Policy-ready automation: Automation applied only to decisions that are stable, measurable, and reversible.

Feedback loop: A closed learning cycle where decisions improve based on measured outcomes.

FAQ

What is decision velocity in business?

Decision velocity is how quickly an organization turns signals into action and learning—compressing detection, interpretation, decision-making, execution, and feedback into a reliable loop.

How is decision velocity different from speed?

Speed can mean rushing. Decision velocity means removing latency—unclear decision rights, slow escalation, disconnected systems, and missing feedback—while preserving quality, control, and learning.

Why does AI increase the importance of decision velocity?

AI accelerates sensing and execution. The bottleneck becomes the organization: decision rights, operational policies, integration, and learning cadence.

Can decision velocity be increased without increasing risk?

Yes—by automating only stable, measurable, and reversible decisions, and by building feedback capture, observability, and refresh rhythms into decision policies.

What should boards focus on first?

Start with high-leverage decision domains (pricing, risk, fraud, service, operations, security). Clarify decision rights, embed decision policies into workflows, and instrument outcomes.

Conclusion: the fastest learners become the most powerful institutions

AI is changing competition, but not in the way most organizations initially think.

The winners will not be those who merely “adopt AI.”

They will be the ones who redesign the enterprise into a faster-learning institution—where decisions improve over time, execution scales safely, and intelligence compounds across workflows.

Decision velocity is how that advantage becomes real:

- Sense earlier

- Decide with clarity

- Act through systems

- Learn from outcomes

- Refresh decision logic continuously

In the AI age, market power increasingly belongs to the fastest learners.

The Enterprise AI Doctrine: From Decision Scale to Institutional Redesign

Over the past few months, I’ve been building a structured doctrine around Enterprise AI — not as a technology trend, but as an institutional redesign agenda.

It unfolds in layers:

🔹 1️⃣ Decision Economics

- Decision Scale: Why Competitive Advantage Is Moving from Labor Scale to Decision Scale

https://www.raktimsingh.com/decision-scale-competitive-advantage-ai/

→ Establishes the core thesis: advantage is shifting from scaling labor to scaling decision quality.

🔹 2️⃣ Institutional Transformation

- The Future Belongs to Decision-Intelligent Institutions

https://www.raktimsingh.com/the-future-belongs-to-decision-intelligent-institutions/

→ Argues that AI leadership is not about tooling — it is about institutional architecture.

🔹 3️⃣ Sector-Level Redesign

- The Institutional Redesign of Indian IT: From Services Firms to Intelligence Institutions

https://www.raktimsingh.com/institutional-redesign-indian-it-intelligence-institutions/ - From Labor Arbitrage to Intelligence Arbitrage: Why Indian IT’s AI Reinvention Will Define the Next Decade

https://www.raktimsingh.com/from-labor-arbitrage-to-intelligence-arbitrage-why-indian-its-ai-reinvention-will-define-the-next-decade/

→ Examines how this shift reshapes industry structure, economics, and competitive positioning.

🔹 4️⃣ Economic Consequences

- The End of Averages: Why Precision Growth Will Define the Next Decade of Enterprise Strategy

https://www.raktimsingh.com/precision-growth-end-of-averages-enterprise-ai/ - What Is the AI Dividend? How Boards Capture Structural Gains from Enterprise AI

https://www.raktimsingh.com/ai-dividend-boards-structural-gains/

→ Explores how decision intelligence translates into measurable structural gains.

🔹 The Unifying Thesis

Together, these articles form a coherent framework:

- Competitive advantage is moving from labor scale to decision scale

- Institutions must evolve from services firms to intelligence institutions

- AI must shift from isolated pilots to structurally governed, economically accountable enterprise systems

This is not AI adoption.It is enterprise redesign.

References and further reading

- John Boyd’s OODA loop and its application to decision advantage. (Wikipedia)

- Dynamic capabilities: sensing, seizing, transforming (David Teece and related work). (David J. Teece)

- BIS research on latency arbitrage and how tiny speed advantages compound in digital markets. (Bank for International Settlements)

- Dynamic pricing as a decision system (managerial overview and research framing). (Harvard Business School Online)

Raktim Singh writes on Enterprise AI, Decision Systems, and Institutional Intelligence. His work focuses on helping boards and executive leaders design intelligence-compounding enterprises in the AI age. Explore more at www.raktimsingh.com.

Raktim Singh is an AI and deep-tech strategist, TEDx speaker, and author focused on helping enterprises navigate the next era of intelligent systems. With experience spanning AI, fintech, quantum computing, and digital transformation, he simplifies complex technology for leaders and builds frameworks that drive responsible, scalable adoption.